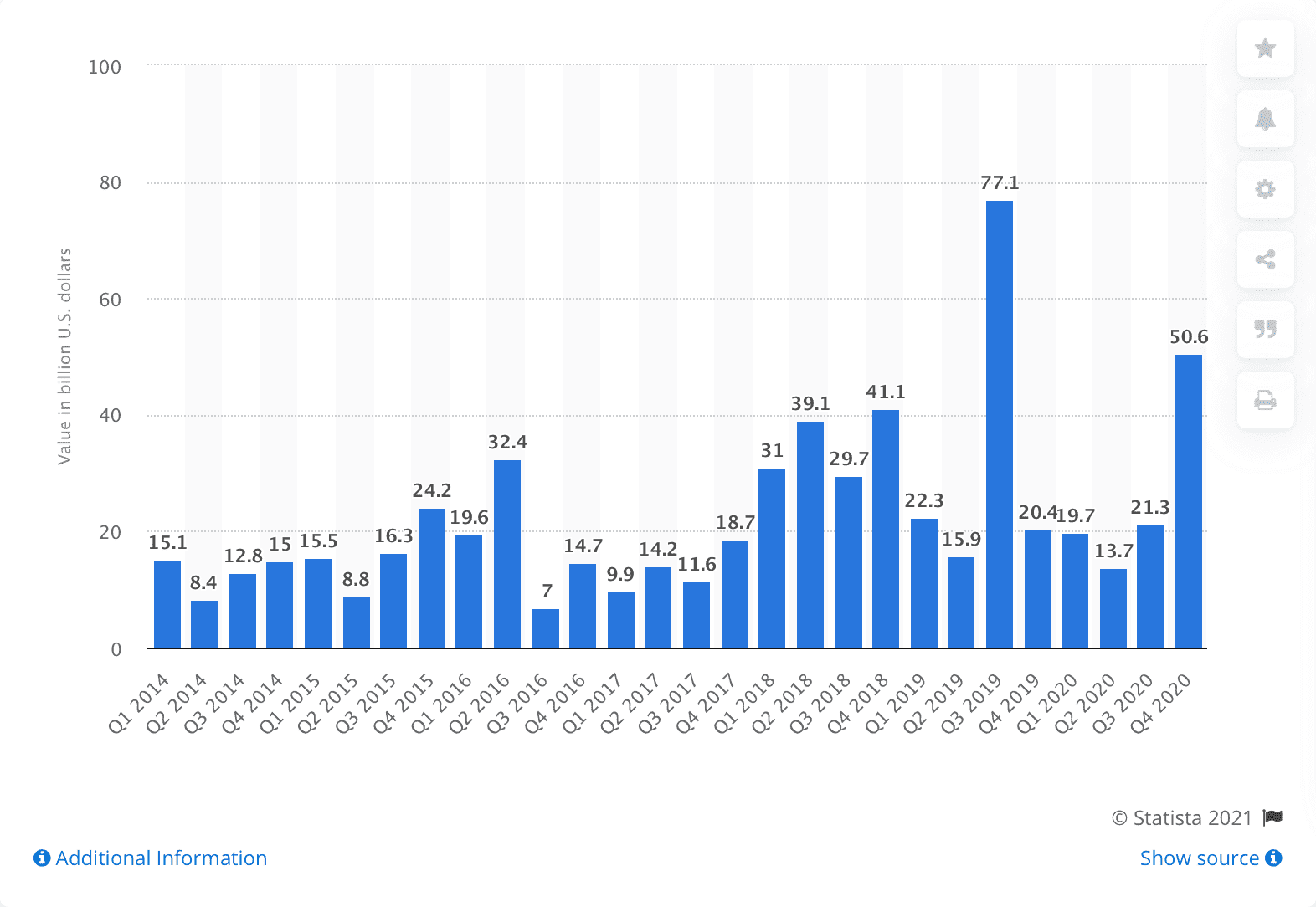

Over a hundred billion dollars was invested into Fintech companies in 2020 alone. Interestingly, the pandemic didn’t really influence Fintech investments much, as the numbers were even bigger in previous years.

There were at least seven billion-dollar acquisitions of fintech companies in 2020, with major players looking to strengthen their position in the market.

Meanwhile, Bitcoin (from under $10,000 to over $50,000) and Dogecoin ($0,01 to $0,4) are leading the cryptocurrency bull run. Also in the blockchain world, NFTs shook up the world of artists and art collectors.

Financial bloggers are calling it the craziest market ever, and everybody’s becoming more interested in the Fintech market.

So, today we’re going to answer seven common questions about fintech software. We won’t get too deep into cryptocurrencies - which is our specialty, and NFTs - which we are super enthusiastic about, because that’s a topic for a much longer article. Instead we’ll focus on Fintech solutions that financial institutions and customers can use to make their life better.

Outline

- What is Fintech software?

- What are examples of Fintech solution companies?

- What technologies are used in Fintech software development?

- What are the types of Fintech software?

- What is the difference between Fintech and banks?

- How do banks use Fintech?

- What are the benefits of Fintech software?

What is Fintech software?

Fintech is the marriage of cutting-edge digital technologies with solutions to the problems of the financial market. Fintech software means all applications and systems built for the financial market.

It’s one of the most important technology markets at the moment, where the biggest digital transformation is happening. For decades, traditional financial institutions relied on physical infrastructure and huge systems built with very old technology, which were very hard to update, change or improve.

In recent years, fintech software development boosted with industry incumbents have started to open themselves up to new technologies. However, digital transformation in this industry is difficult.

The difficulties come from the fact that Fintech software solutions has to meet a lot of strict requirements:

- Security - data privacy is one of the biggest issues of our time. In Fintech, this issue is exponentially more difficult than in most other markets. If things go wrong with Fintech software, you’re not “just” leaking your address or phone number to unwanted people. You lose money, and lots of it.

- Compliance - it’s not enough to build Fintech software that works. It has to be super secure, but also comply with a huge number of regulations that are standard for the financial market. If the solution is meant to be global, then you have to comply with international regulations, and separate regulations for all countries your business operate in.

- Bleeding edge - to compete in the financial services, your software will likely need to use bleeding edge technologies like blockchain technology, big data systems, and machine learning models. Finding software development companies that have skilled team in these technologies is difficult and expensive.

- Usability - amidst all of the above, you still have to make Fintech software solutions pleasant to use. Customer experiences are nowadays extremely important, a good user experience can make or break your product, especially in Fintech services. If users don’t feel comfortable with your application, they’ll probably go for other products that make them feel safer.

What are examples of Fintech solution companies?

We all know PayPal, the 20-year-old digital payment provider. You probably also know Revolut, founded in 2015 and already one of the most popular digital banking products. But there are hundreds of other major Fintech players that offer a vast range of different digital financial services. Let’s look at a few interesting examples:

Gusto

Gusto is a powerful, easy-to-use platform that combines payroll and benefit management with innovative HR solutions. It supports over 100,000 small and medium companies in the US. Gusto has been around since 2021, and received $516.1M total in funding.

Stripe

Stripe is kind of like PayPal, but much more powerful and with a much wider suite of solutions. They provide the whole payments stack that you need to safely run your business online. Stripe is used by millions of companies around the world, including the biggest players like Google, Amazon, Salesforce, Shopify, Spotify, and much more. It’s been around since 2010, and received $2550.9M total in funding.

Klarna

Klarna is a digital payment provider for e-commerce. One of their most revolutionary solutions is after-delivery payment, where the customer pays online after receiving the order. Klarna supports over 250,000 e-commerce stores in 17 countries. It’s been around since 2005, and received $2832.7M total in funding.

Onfido

Onfido is built for identity verification in government and financial systems. It’s used by Revolut, among plenty of other institutions that require ID verification in their services. It’s been around since 2012, and received $209.5M total in funding.

Robinhood

Robinhood is an easy-to-use application for consumers to trade on financial markets. It lowers the entry barrier of trading, allowing pretty much anyone with a mobile device and internet access to become a trader. It’s been around since 2013, and received $5572M total in funding.

Coinbase

Coinbase is the biggest cryptocurrency trading platform at the moment. This is the place you visit when you want to sell your Bitcoin. It recently went public, with shares costing over $300. It’s been around since 2012, and received $538.7M total in funding.

Lendingblock

Lendingblock enables institutional investors to safely borrow cryptocurrencies. Our team of software developers actually built the platform for Lendingblock, and we continue to work with them. They’ve been around since 2017, and received $10M total in funding.

What technologies are used in Fintech software development?

Because of the challenges we mentioned earlier (security, compliance, bleeding-edge, usability), Financial software development is mostly built with tried and tested, mature technologies. In such financial services, you don’t want to be wrangling a buggy technology that hasn’t already been secured against all possible exploitations.

The favorite technologies of Fintech developers are:

Programming languages:

- Python

- Java

- Ruby

- JavaScript

Frameworks:

- Node.js

- Django

- Ruby on Rails

- Spring

What are the types of Fintech software?

There are 19 types of Fintech software, as reported by CBInsights:

- Accounting & Finance

- Asset Management

- Business Lending & Finance

- Capital Markets

- Core Banking & Infrastructure

- Credit Score & Analytics

- Crypto

- Digital Banking

- Financial Services & Automation

- General Lending & Marketplaces

- Insurance

- Mobile Wallets & Remittances

- Payments Processing & Networks

- Payroll & Benefits

- Personal Finance

- POS & Consumer Lending

- Real Estate & Mortgage

- Regulatory & Compliance

- Retail Investing & Secondary Markets

What is the difference between Fintech and banks?

In short - Fintech is lean and digital, and traditional banks have a vast physical infrastructure and a huge workforce.

The way that the financial market is structured at the moment, the difference between traditional banks and Fintech is gradually becoming more blurry. Fintech is basically becoming the new finance.

Fintech companies need to meet the same requirements as traditional financial institutions. For example, just like normal banks, digital banks need to meet stringent regulations and get banking licenses.

Some Fintech companies offer conventional financial service, but for the digital world. Others offer completely new, disruptive services that were completely impossible a few decades ago.

Will digital banks like Revolut and Nubank replace conventional banks in the future? It’s hard to say. Traditional banks, like Goldman Sachs or Citi, have been investing in Fintech products quite heavily in recent years.

Ultimately, what we see in the financial market is not an arms race between digital and traditional. It’s more of a convergence. Some fintech players will become part of traditional banks, others will remain independent and offer specialized financial services for specific customer segments.

How do banks use Fintech?

Banks use Fintech solutions to provide better services to a wider range of consumers. This starts with simple transformations, like adding a digital account management platform to a traditional financial institutions. And from there, the possibilities are endless.

- Using big data, machine learning and blockchain solutions, banks can optimize their operations, improve the payment process and provide innovative financial products.

- Legacy bank codebases can be broken down and rebuilt using newer, more efficient technologies and agile development methodologies.

- Using API-driven development, banks can integrate with a wide range of different Fintech products in order to offer better services to consumers.

- With process automation, banks can greatly reduce the amount of manual grunt work that their employees need to do. Their workforce can grow, become more creative, and focus on creating value for the institution instead of manual tasks.

- Ultimately, Fintech software can generate a lot of improvements and optimizations for banks. Plus, banks simply can’t afford not to adopt Fintech products, because consumers expect them to do so. Once you’ve used a great digital banking platform, you’re not going to go back to a bank that offers a worse experience.

What are the benefits of Fintech software?

Compared to traditional financial services, modern software is:

- Lightning-fast - no more waiting for transactions or credit approvals.

- Secure - you can be sure that your data won’t be seen by unwanted eyes.

- Personalized - with personalization algorithms, banks can offer unique services to those customers who want them.

- Cheaper - software requires a large initial investment, but it saves costs for financial business over time.

- Safe - the risk of financial transactions and operations can be reduced by using Fintech technologies.

- Transparent - you don’t have to guess, software gives you data about the state and performance of your systems.

- Compliant - once implemented, this innovative software makes it easier to create compliant products and services.

Summary: The state of financial software development

Fintech is becoming the new finance. Traditional institutions and modern Fintech companies are converging to form a new market, where everything is digitized and consumers get secure, reliable, super-fast financial products and services.

For us at Ulam Labs, it’s an exciting transformation that we’re proud to be a part of, with products like Lendingblock in our portfolio, and new ones on the way.

Ready to find a Fintech software development company you can trust?

At Ulam Labs we have developed specialized expertise in blockchain technology. Our Fintech software development services have gained recognition by various research & analytics hubs that compiles the lists of the leading software outsourcing companies. We are placed among top blockchain development companies in 2020 by Techreviewer and Clutch. Recently Clutch listed us as a top blockchain partner for 2021.

We are also official partner of Algorand - a blockchain platform with the high performance needed for real-world applications making this platform our top choice for the majority of our projects.

If you are looking for software development service provider focusing on Fintech technology, have a look at our portfolio. We have build various products like cryptocurrency lending platforms, personal finance products, cryptocurrency exchanges and many more. We can be your Fintech software development partner helping you realize your idea.

.svg)

.png)