Some people might think that cryptocurrencies are only used for online payments. That is a serious misconception, as one of the driving forces for crypto in 2020 and 2021 was Decentralized Finance. DeFi offers finance instruments similar to the ones available in a bank, but it does so in a technologically sophisticated fashion. This makes financial transactions more robust, transparent and secure. Just like a bank offers mutual funds, filing taxes, checking the credit card balance, etc., the DeFi does the same.

In 2021, DeFi emerged as one of the greatest contributions of blockchain technology to the world of finance. With the steady transfer of financial services from legacy institutions to decentralized systems, the total value locked (TVL) in DeFi has grown to $190.5 billion. According to the DeFi protocols’ TVL rankings, Compound occupies the 5th position with a TVL of $10.57 billion.

Compound is creating ripples in the crypto market for the right reasons. In this article, we will tell you what the hype around Compound is about. So let’s get started.

Outline

- What Is Compound protocol

- How Does Compound protocol Work?

- How Does Compound Interest Work?

- What Is The Compound Interest Formula?

- The COMP Token

- Is Compound Protocol Safe To Use?

- What Are The Benefits Of Using Compound?

- What Are The Alternatives To Compound?

What Is Compound protocol?

First things first. Compound is a DeFi borrowing and lending protocol built on Ethereum that functions as the blockchain version of a money market.

An analogy with legacy financial institutions might help you understand things better. You must have a savings account in your bank where you deposit money to earn interest. Similarly, DeFi protocols like Compound allow you to invest your crypto savings, since your money grows from the interest earned. Just like you can take loans from a bank, Compound also lets you take a loan against collateral.

We will explain in detail how you can start ‘Compounding’ your crypto savings. But before that, you must know which of the cryptocurrencies Compound supports. The list is as follows:

- Ether (ETH)

- USD Coin (USDC)

- Tether (USDT)

- Wrapped BTC (WBTC)

- Basic Attention Token (BAT)

- Augur (REP)

- Dai (DAI)

- Ox (ZRX)

- Sai (SAI)

- Uniswap (UNI)

- ChainLink Token (LINK)

- TrueUSD (TUSD)

- Aave Token (AAVE)

- Maker (MKR)

- Sushi Token (SUSHI)

- Yearn Finance (YFI)

How Does Compound protocol Work?

You can diversify your investment portfolio when you start putting your savings into Compound. In return, the protocol will keep paying interest to you for the entire time period that you keep your money. However, if you wish to make some investments elsewhere, you can also take loans from the protocol. Quite naturally, it is you who will pay interest to Compound for borrowing money from the protocol’s liquidity pool.

As it is already evident by now, Compound constitutes two main actors: lenders and borrowers. Let us explicate their role and how they work in the Compound ecosystem.

Lenders

Lenders deposit or lock their crypto into Compound to earn money at a dynamic annual interest rate. Each particular token is stored in a liquidity pool of the same token using Compound’s sophisticated smart contracts. Lenders receive the Compound interest in the same token that they deposit in the pool. Thus, if you lend ETH to Compound, your interest Compounds in ETH. Similarly, if you deposit USDT, you will get your Compound interest in USDT.

Borrowers

Borrowers can take a loan against their crypto balance in the Compound protocol. When you borrow money from a bank, they usually do a personal finance background check to determine credit ratings. However, Compound, is keeping up with DeFi’s promise of anonymity and never inquires about personal finance. Thus, in order to avoid debt and bankruptcy, Compound only offers over-collateralized loans. The protocol sets a borrowing limit/collateral factor to determine how much a user can borrow.

Since you are taking money from the protocol, you need to pay Compound interest on it. Examples help us visualize a system, so let us use one to explain how it functions. Suppose Bob deposits ETH worth $10K into Compound. If the borrowing limit is set at 60%, then he can borrow $6K worth of any cryptocurrency from Compound. However, he needs to pay Compound interest on the borrowed amount.

How Does Compound Interest Work?

Unlike banks where interest rates are fixed, Compound interest works in a dynamic fashion. The Compound interest keeps changing depending on the balance of a particular liquidity pool.

When the total amount of crypto in a liquidity pool is abundantly available, the annual interest is low for lendings. However, for a smaller pool with a lesser balance, the Compound Annual Growth Rate is high. This means the annual return is greater for lending crypto to smaller liquidity pools. This kind of floating interest works well to maintain some equivalence in the crypto market. Users are thus incentivized to supply liquidity to smaller pools because the Compounding interest is higher.

Similarly, the interest rate for borrowing from a larger pool is less since there is sufficient money to borrow. On the contrary, the interest rate is higher when someone borrows from a small liquidity pool.

What Is The Compound Interest Formula?

The question that still needs answering is how to calculate Compound interest. In banks, you earn simple interest on the initial principal that you deposit. But Compound interest works differently. The principal amount is compounded daily so that your money witnesses exponential growth at an incredibly faster rate. In banks, your savings are locked in for long periods that can be as long as nine years. With the DeFi protocol’s daily compounding interest, you don’t need to wait so long.

In fact, the compounding period is as small as a few seconds. With a phenomenally high annual growth rate, the accumulated interest on your original principal can be sky-high. Although the interest rate is displayed for annual terms, Compounding periods are as low as 15 seconds. This is approximately the time it takes to mine an Ethereum block.

Compounding works with the cTokens that lenders get for their investments in the protocol. It is these ERC-20 tokens that appreciate in value from the accrued interest. As per Compound’s financial calculator, cTokens’ value has a growth rate of 1/2102400 of the annual interest rate. The value of cTokens increases in value by the aforementioned growth rate every 15 seconds.

The obvious advantage of such short Compounding periods is that you will be earning interest on a daily compounding basis. This means you don’t need to wait for monthly interests. With a floating interest rate, the returns on your initial investment will also be significantly higher. Overall, compounding interest on your starting amount will give you larger returns on your money.

The COMP Token

The COMP token is a powerful force that runs the Compound protocol. It is a governance token with which the token-holders can propose changes and vote on them. Token-holders play a significant role in deciding the future of the Compound protocol.

COMP is also the rewards token for Compound’s liquidity mining. Whenever a lender adds cryptocurrencies to Compound’s liquidity pools or borrows from these pools, they get COMP tokens. COMP is distributed every 15 seconds (Ethereum mining period) in proportion to user’s interest. Everyday, 2,880 COMP tokens are rewarded to lenders and borrowers in a 50:50 ratio for maintaining Compound’s liquidity pools.

Is Compound Protocol Safe To Use?

Now that you know you will have your interest compound from this DeFi protocol, the bigger question still remains. Is it safe to put your money into Compound as an investment strategy?

That’s not a financial advice but from the technical standpoint, the Compound protocol is safe. DeFi projects are subject to frauds and hacks due to faulty and bug-ridden smart contracts. An elaborate smart contract audit rules out the possibility of such hacks. OpenZeppelin and Trail of Bits have conducted multiple security audits of Compound, and received its formal verification from Certora. However, a DeFi bug mistakenly distributed COMP tokens worth $90 million to users. It didn’t put users assets at risk, rather than was an effect of a smart contract bug that was issued with a regular update.

Additionally, there are 3 more factors that make Compound a safer space to invest crypto:

Public Code

Compound’s code is available in the public domain. This means any programmer with a technical background can easily spot errors in the code.

Bug Bounty Program

Compound offers a reward of $500-$150,000 to white hat hackers for detecting and ethically rectifying security vulnerabilities. This rewards program incentivizes keeping the protocol safe from any undiscovered bugs and faulty code.

Dynamic Interest Model

Compound operates on a floating interest rate that effectively rules out any possibilities of a ‘bank run’. The supply-demand ratio in crypto markets determines the interest rate which makes your crypto investment balance safe.

What Are The Benefits Of Using Compound?

The benefits of using Compound are manifold:

- Anyone with crypto can open an account and get monthly returns for investing. Since the interest compounds annually, lenders have a source of passive income.

- The Compound interest protocol allows for bitcoin investing with WBTC listing.

- COMP tokens power the Compound interest platform. This makes it a community-oriented crypto project where the community holds decision-making powers.

- All transaction data on the Compound protocol is immutably recorded on-chain. The robust security audits ensure safety as well.

- Over-collateralized loans and dynamic interests ensure that the Compound interest protocol will never run into debt.

What Are The Alternatives To Compound?

There are several other solutions where you can open an account to diversify your crypto investment plans. As long as you don’t have debt, you will keep earning interest on your crypto investing schemes. Following are 3 such alternatives:

Venus

Venus is a DeFi platform and a blockchain money market built on the Binance Smart Chain (BSC). The lenders and borrowers use BEP-20 assets to make fast, low-cost transactions. The protocol provides a good opportunity for investing since your crypto asset’s interest is based on market demands.

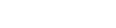

BlockFi

BlockFi is a platform where you can transact cryptos and earn as much as 8.25% monthly interest on your investment. You can also take a loan for just 4.5% interest. Simply enter your information to open an account, and get access to over $10 billion-worth of assets. There’s a catch, though – if you’re looking for decentralization, BlockFi is a centralized solution, with all its advantages and disadvantages.

Aave

Aave is the largest DeFi borrowing and lending protocol on Ethereum with $16 billion in TVL(Total Value Locked). It supports 17 cryptocurrencies for its lending pools, and provides aTokens for each supporting cryptos. These aTokens are interest-holding tokens through which all lenders and borrowers receive or pay interest. The protocol is powered by AAVE token which functions as a governance token.

Want To Offer Crypto Lending & Borrowing Services?

Compound is an interesting solution for those that want to leverage their digital assets and earn interest on their holdings. If you hold a crypto asset for the long term and don’t want the risk of day trading, it’s a great mechanism of maximizing your long-term investments – although it works for the short-term, too. It also allows you to leverage crypto by borrowing on an interest rate calculated by the protocol

However, if the available solutions are not satisfying for your client base, you can build your own. We have successfully deployed Lendingblock which allows for institutional crypto lending & borrowing – feel free to read more about it in our case study and contact us if you’d like to integrate such solution. We have also built such solution for retail.

Want to leverage crypto lending & borrowing? Let’s get in touch!

.svg)